Sales tax on digital services

We are required to charge sales tax (VAT/GST) on certain digital services supplied to all private consumers and most organisations in the United Kingdom or in the European Union. At this time, we do not charge sales tax on digital services supplied to clients located in other countries.

Answers to common questions about sales tax (VAT/GST) on digital services are provided below. Please note that regulations in different countries can and do change regularly. Please check back for updates. Our subscriptions website will quote sales tax as required by current regulations.

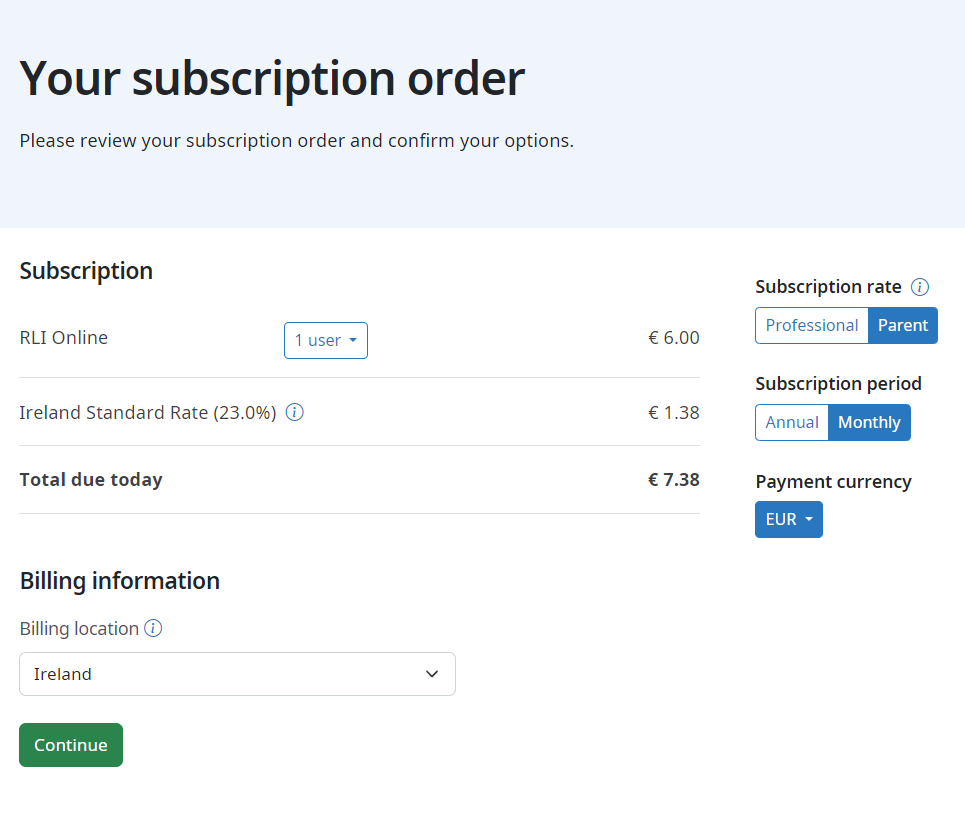

Will I be charged sales tax on my subscription?

We will charge a sales tax (VAT) if one of the following is true:

- you are purchasing as a private individual, and you are located somewhere within the European Union or within the United Kingdom

- you are purchasing on behalf of an organisation or as a taxable person located in the United Kingdom

- you are purchasing on behalf of an organisation or as a taxable person located in the European Union and you are unable to provide a valid VAT registration number

If you are located outside the United Kingdom and outside the European Union, we will no charge sales tax.

Are all of your subscription services 'digital services'?

Yes, at this time, all of our online courses and RLI Online are categorised as digital services for the purposes of supplies with the United Kingdom and the European Union.

What rate of sales tax will I be charged on my subscription?

If you are located in the United Kingdom, digital services are subject to the current standard rate of VAT.

If you are located in the European Union, digital services are subject to the appropriate rate set by the country you are located in.

How is my location determined?

If sales tax is applicable, we will determine your location based on the Internet network address of the device you are using to access our subscriptions site and the billing address for your chosen payment method.